oregon tax payment system

You may use this Web site and. Overview of Oregon Taxes.

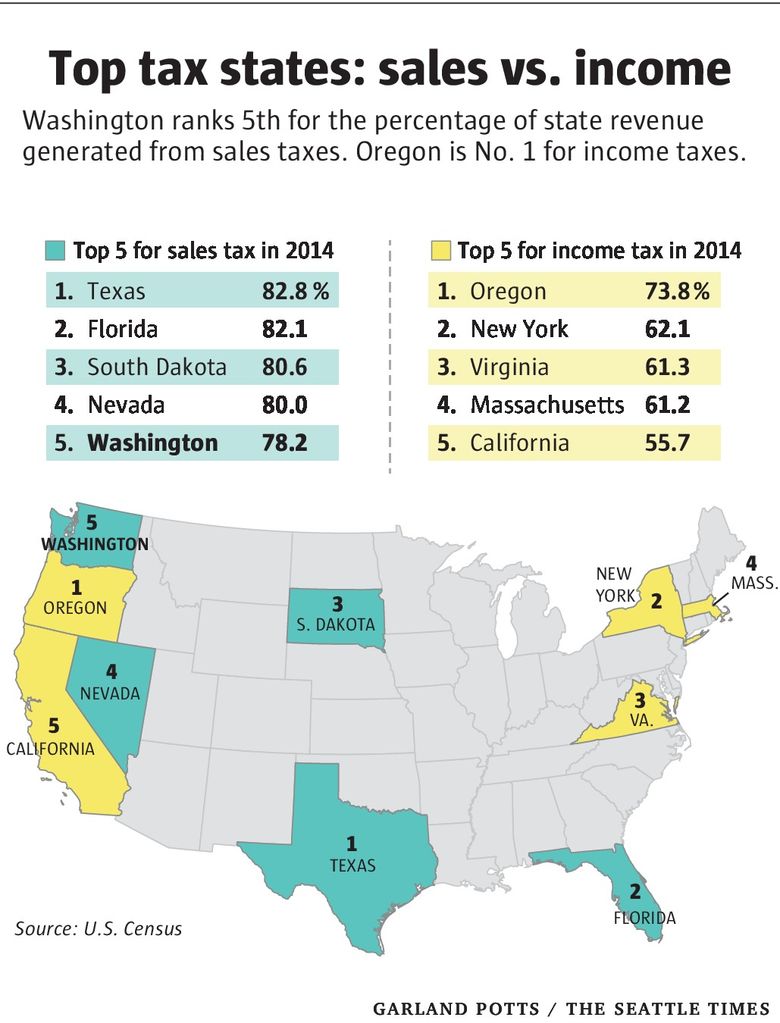

Taxes Like Texas Washington S System Among Nation S Most Unfair The Seattle Times

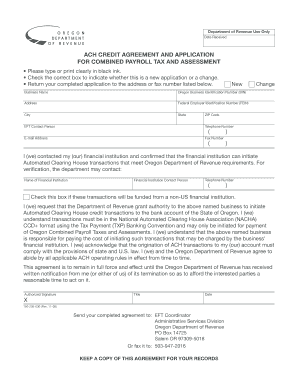

The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and.

. Marion County mails approximately 124000 property tax statements each year. Electronic payment using Revenue Online. Oregon Tax Payment System Oregon Department of Revenue.

Oregon has a graduated individual income tax with rates ranging from 475 percent to 990 percent. OTTER is no longer available as it will be decommissioned after the second quarter Q22019. EFT Questions and Answers.

Are you ready to file. Select a tax or fee type to view payment. Service provider fees may apply.

Oregon Department of Revenue Payments. Cigarette and tobacco products licensing. The Oregon Payroll Reporting System OPRS is replacing OTTER.

If you did not receive an Access Code to reactivate your. Oregons personal income tax is progressive but mildly so. There are also jurisdictions that collect local income taxes.

Cigarette and tobacco products tax. Marginal tax rates start at 475 percent and as a taxpayers income goes up rates quickly rise to 675 percent and 875. Be advised that this payment application has been recently updated.

To electronically pay state payroll taxes including the WBF assessment by electronic funds transfer EFT use the Oregon Department of Revenues self-service site. An official website of the State of Oregon Heres how you know. If you are signing in to your account for the first time please follow this link and use the Access Code sent to your business.

This EFTPS tax payment service Web site supports Microsoft Internet Explorer for Windows Google Chrome for Windows and Mozilla Firefox for Windows. Choose to pay directly from your bank account or by credit card. Cookies are required to use this site.

Your browser appears to have cookies disabled. Oregon has a 660 percent. Residents of the greater Portland metro.

Home Departments Tax Pay Online TaxPay Online Businesses Individuals Taxpayer Assistance Tax FAQs DepartmentsCity Directory Building Zoning Cemeteries City of Oregon. Oregon levies a progressive state income tax system with one of the highest top rates in the US at 990. Cigarette and tobacco products inspection process.

The statements are mailed between. LoginAsk is here to help you access Oregon Tax Payment System quickly and. Corporate Income and Excise.

Oregon Tax Payment System will sometimes glitch and take you a long time to try different solutions.

6 Things To Keep In Mind About Oregon Taxes Oregon Center For Public Policy

A Homeowner S Guide To Oregon Property Taxes Pacres Mortgage

Tax Alert Notice February 2020 Session Oregon Tax News

How Do State And Local Individual Income Taxes Work Tax Policy Center

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

E File Oregon Taxes For A Fast Tax Refund E File Com

State Of Oregon Oregon Department Of Revenue Home

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Oregon Tax Payment System Fill Online Printable Fillable Blank Pdffiller

Oregon Democrats Unveil Plan For Tax That Raises 1 4 Billion For Schools

Is My Income Non Taxable Do I Need To Pay The Tax Arts Tax Forms The City Of Portland Oregon

New Oregon Payroll Tax Takes Effect In July 2018

State Of Oregon Oregon Department Of Revenue Home

Oregon Tax System Explained Youtube

Oregon Tax Experts Analyze Methods Used In Trump Tax Returns Kgw Com

Timber Tax Fairness Tax Fairness Oregon

Unique Tax System Keeps Oregon Weird In The Wrong Way Oregonlive Com

Oregon S Tax Reconnect Adds To Life S Uncertainties Oregonlive Com